Nothing found

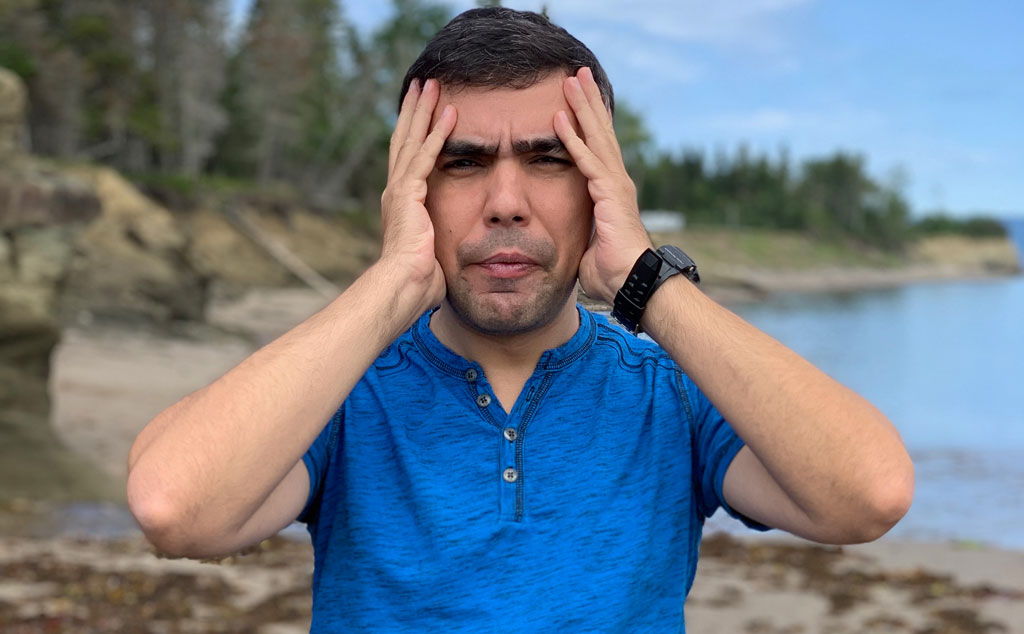

Hello, I'm Alex Pavlenko. I founded the Immigrant.Today portal in 2015. During this time, my team has published thousands of articles, and now, for some reason, the script could not find the appropriate material for your search query.

I'm very embarrassed that this happened. I'm just sure our website has the article you need!

Here are links to the most popular sections of the website: